- Dallas, TX

- $15 Million

What is C-PACE?

A great fit for your project

What is C-PACE Financing?

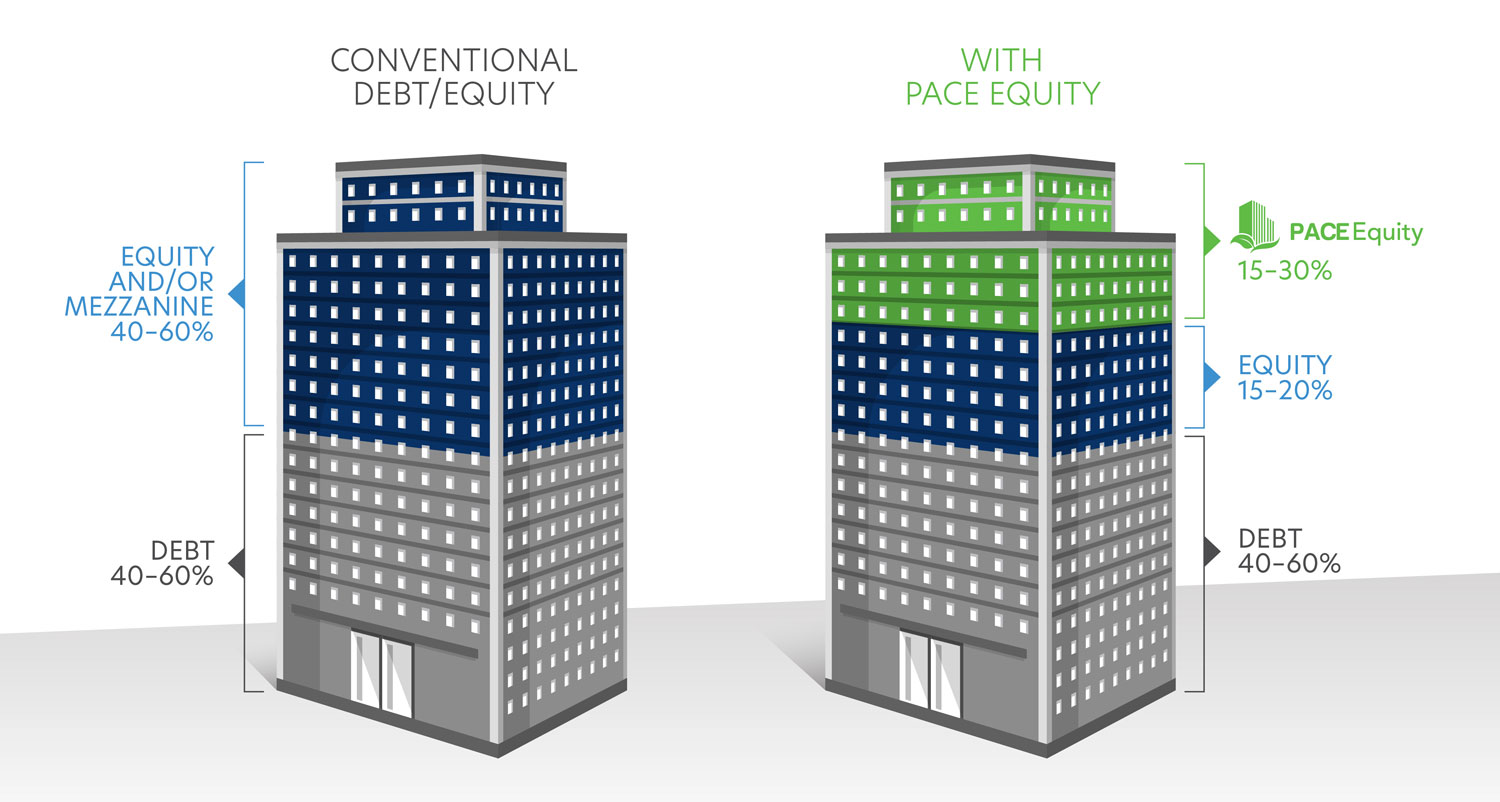

Property Assessed Clean Energy (PACE) is a legislated public/private partnership that creates a new financing option for your capital stack. Your construction budget can use our private capital funding for costs that impact energy & water spend, renewable improvements, or seismic strengthening (select states). The repayment of our capital is made through a long-term special tax assessment on the property.

C-PACE designates the Commercial version of PACE. PACE Equity exclusively funds commercial real estate projects.

Can I use PACE Equity and get green building verification?

Yes! PACE Equity now offers a low carbon option called CIRRUS™ Low Carbon financing which combines C-PACE financing with a low carbon verification by a third party. The program provides financial benefits, including a reduced rate, for pursuing enhanced energy efficiency. We add a building plaque and marketing toolkit so your low carbon building gets the promotion it deserves. We’ll build a business case to show you how the financial benefits compare to any incremental design costs.

"We had a great experience with the whole team at PACE Equity. The team moved us quickly and professionally through the C-PACE process with no surprises."

Shawn Neece

Principal, Renew Partners

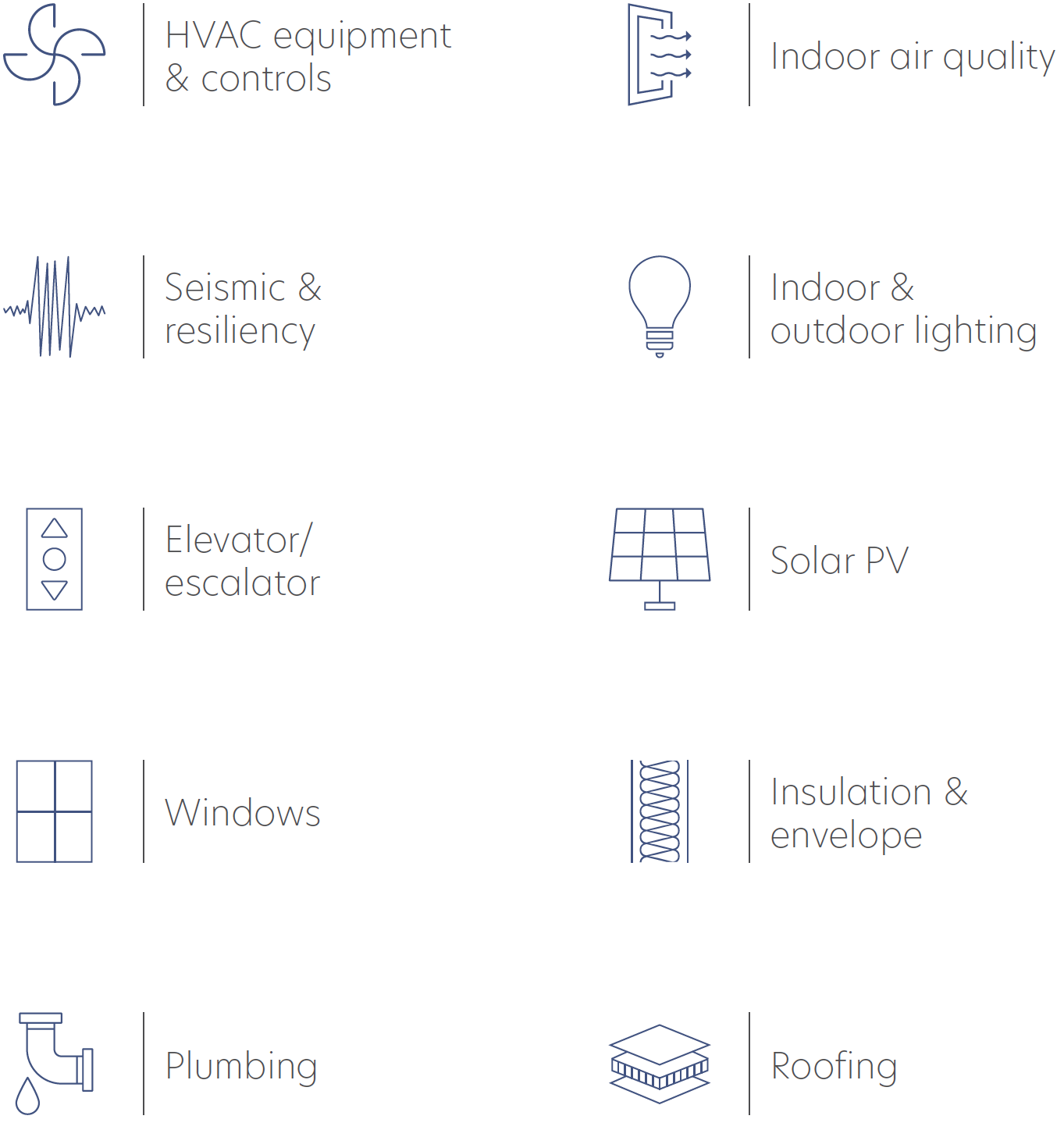

Which Improvements are Eligible to Calculate Available Funding?

It is not a requirement to change your building design when you work with PACE Equity. Projects can qualify with the design you already have planned.

Keep in mind that this is not an exhaustive list; every state has unique options for eligibility. Some states have special “Savings to Investment Ratio” requirements. In all cases, states and municipalities want to encourage sustainable building practices. C-PACE financing provides a win for developers/owners AND for communities.

One Minute Video

PACE Financing Eligible Improvements

What Kinds of Projects Does PACE Equity Fund?

What Asset Classes does PACE Equity fund?

C-PACE Requires 87 Steps… And We Do Them All

We’ve created a unique process that maximizes your funding and amortization term. We’ve learned from the hundreds of projects we’ve done across our own engineering and leadership teams. Our end-to-end process delivers a seamless experience you can only find at PACE Equity:

- Binding funding commitment (not just a term sheet)

- In-house energy engineering that delivers maximum funding and term

- Design guidance to help with suggestions to maximize funding amounts and qualify for our lowest rates

In short, we manage the details, so you can focus on your project.

"When everything else was complicated, PACE Equity stood out as easy."

David Crisafi

Principal, Ceres Enterprises

Why Should I Use C-PACE Financing?

- Boosts project IRR

- Replaces higher cost mezzanine and equity capital

- Keeps your equity 100% internal for a larger ownership percentage

- Offsets high equity requirements with low-cost financing

- Reduces high-cost debt funds to lower your WACC

- Reduces personal risk with non-recourse funding

- Increases net operating income and property value

- Long-term, fixed-rate financing with up to 30-year terms

What’s the Difference between PACE and C-PACE?

You’ll find that we use the terms “PACE” and “C-PACE” interchangeably. PACE stands for Property Assessed Clean Energy and denotes a legislation that states and municipalities use to encourage sustainable building practices. C-PACE designates the Commercial version of PACE. PACE Equity exclusively funds commercial real estate projects.

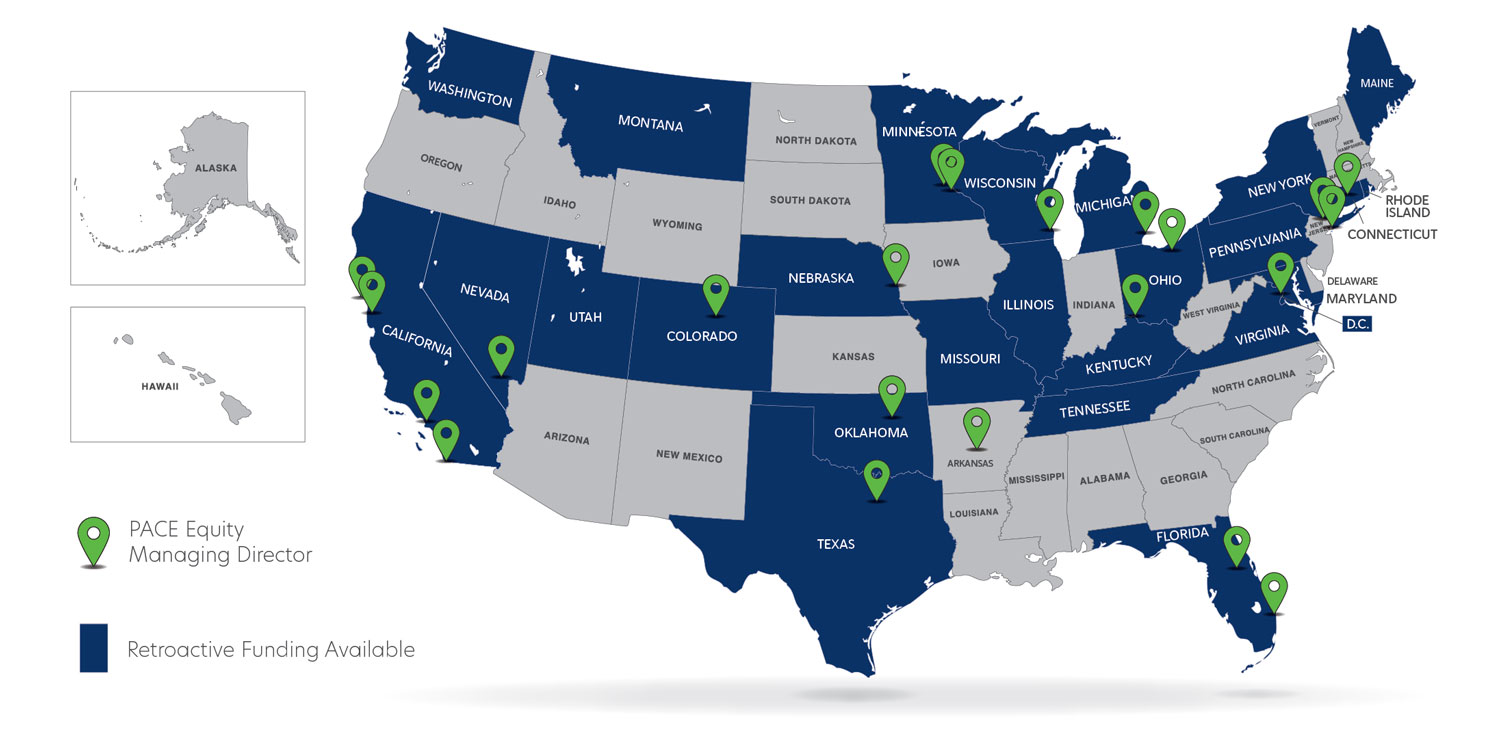

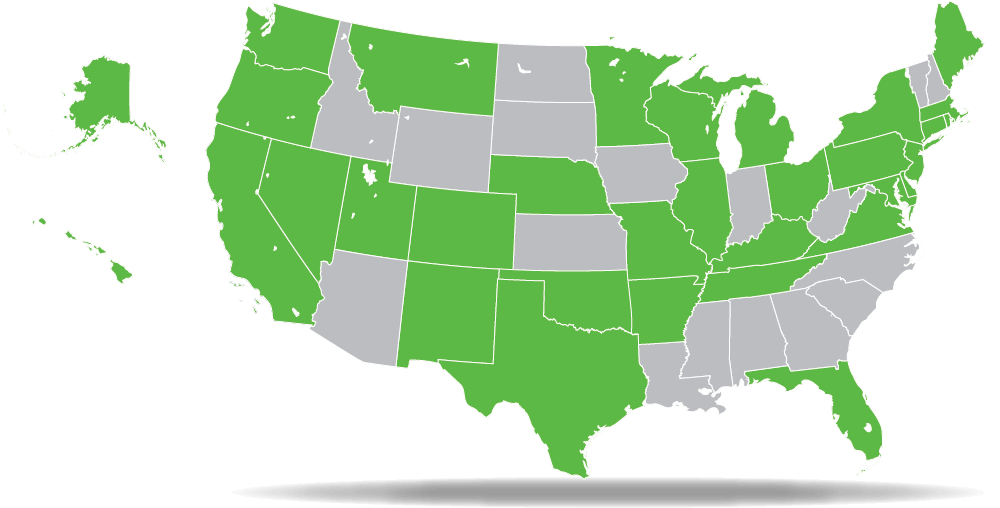

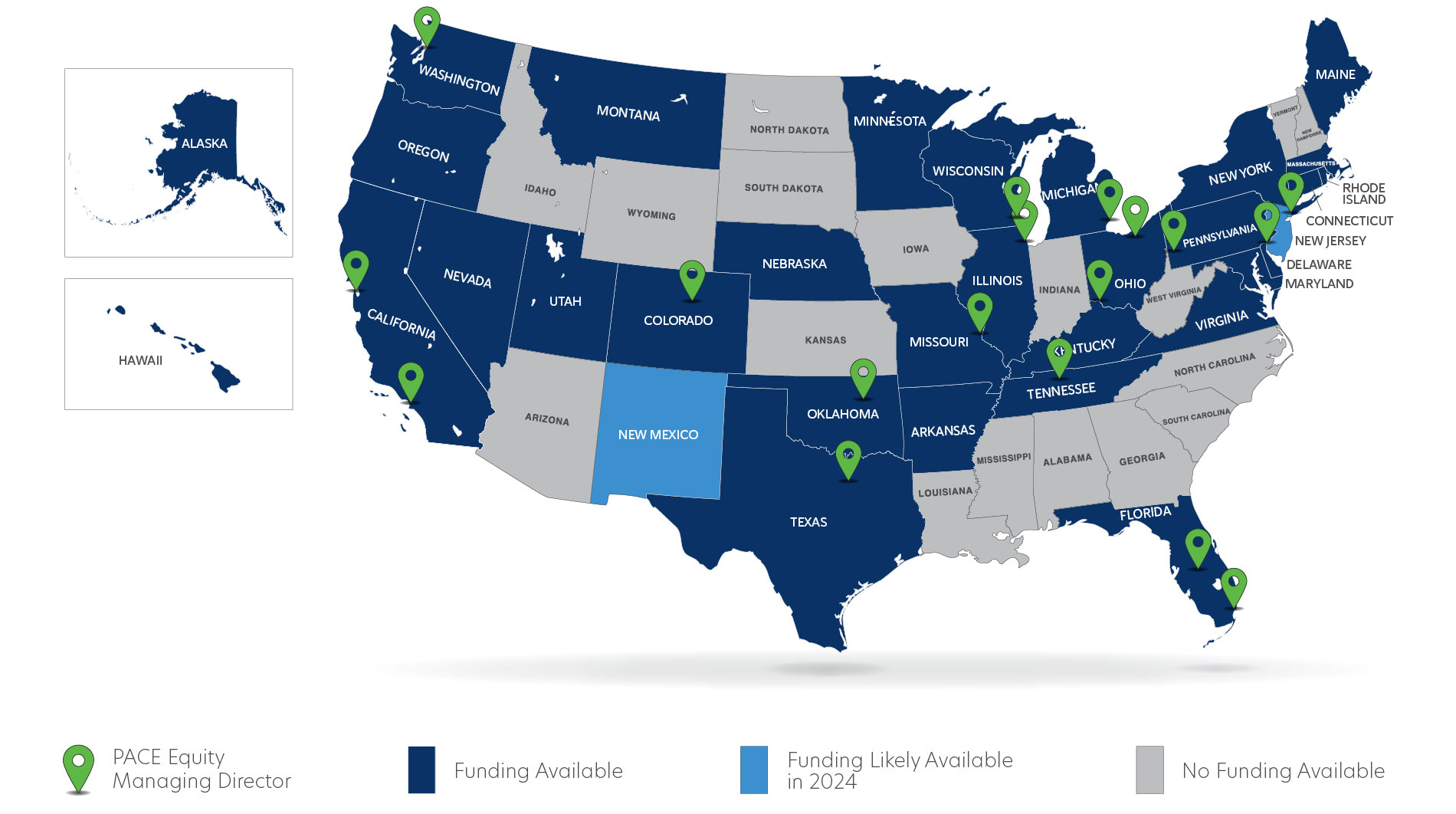

Where Is PACE Equity Financing Available?

PACE Equity is available in states and cities across the U.S. and continues to grow. We believe in working locally and building long-term relationships. As C-PACE legislation expands, so do we.

We are committed to forming local, lasting relationships. Our Managing Directors are not only experts on C-PACE Financing, they're your neighbors.

Can I Get Funding for Completed Projects?

Yes! In certain states, retroactive refinancing is available for projects completed within the last 2 years. This is an excellent way to:

- Get access to liquidity reserves

- Reduce debt

- Refinance equity

- Cover cost overruns

You can take advantage of prior improvements which impact utility spend (HVAC, lighting, windows, etc.), renewable energy measures, and/or seismic retrofits (in certain states). Our engineers analyze your building improvements and then calculate the maximum amortization starting from when the improvements were installed. Your funding amount is based on this retroactive energy savings.

Read our Insights article on Retroactive Refinancing: How PACE Equity can help fund your recently completed renovation or development project.

More Questions? We Have Answers.

Review the Frequently Asked Questions from developers, owners & lenders.

Or contact us — we are glad to answer your questions and talk through your next project.

Short on time? Fill out an online application form to Get Started.

Video

Watch our 30 minute webinar on PACE Equity financing and the option for CIRRUS Low Carbon financing

Play Video

Menu

Recent Closings

- Ashwaubenon, WI

- $1.1 Million

- Lake Worth Beach, FL

- $12.7 Million

- Tomball, TX

- $2.9 Million

- Port St. Lucie, FL

- $9.1 Million

© 2024 PACE Equity, Inc. All rights reserved | Privacy Policy

Website by LimeGlow Design