- How can I get liquidity out of my project?

- How can I qualify for financing if I’ve completed my project?

- How can I obtain additional financing for cost overruns?

The answer to these questions is Retroactive Refinancing from PACE Equity.

What is the funding mechanism?

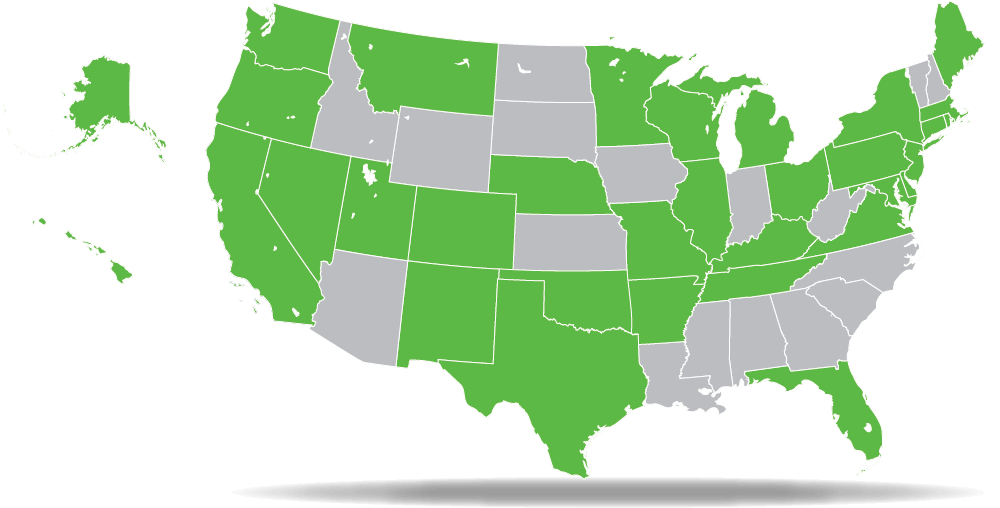

PACE Equity offers financing and end to end execution to leverage a legislated public/private financing tool which could be the solution for funding your next renovation or development project. Over thirty states have adopted the use of this financing tool, and often these states have various sub-entities who use slight variations of the state-level statute. PACE Equity has experience in working with both the states and the sub-entities. Using this experience and a creative approach, PACE Equity can even retroactively fund a renovation or new construction project using retroactive refinancing. This strategy is especially useful when you are looking for:

- Access to liquidity reserves

- Reduction of debt

- Coverage for cost overruns

How does retroactive refinancing work?

The solution leverages your investment in recently completed development projects or building renovations. You can take advantage of those prior improvements which impact utility spend (HVAC, lighting, windows, etc.), renewable energy measures, and/or seismic retrofits (in certain states).

Our engineers analyze your building improvements and then calculate the maximum amortization starting from when the improvements were installed. Your funding amount is based on this retroactive energy savings (about half of the states require it for SIR compliance). So not only do you have improved building value and lower operating costs, you can leverage the savings to acquire funding at lower rates than mezzanine or equity.

Here are a few examples where retroactive refinancing was applied:

- Cost overruns: this California developer needed additional capital for unexpected costs to avoid investing more equity.

- Debt reduction: this Midwest developer leveraged recently completed renovations to access funding for their global refinance.

Increased amortization schedules from previously installed energy efficiency measures make access to needed liquidity, reduction of debt and even funding for unforeseen cost overruns a viable strategy in those states where PACE Equity funding is available. Is this a potential solution for your next project or refinance?

Contact PACE Equity to find out.