With over 200 projects under our belts, we’ve learned a few things. We’ve learned that there is one proven way to maximize the amount of available funding and we’ve got the process to get it right, every time. We call the process our Fast Track™ Funding process, but it isn’t all about speed. It is about sizing correctly, so you get both the maximum amount of financing at a low cost AND you get the optimal amortization term.

Why does this matter? So you can optimize your design and the IRR on your project.

An energy study is required for every PACE public/private partnership financing project. This can be done by a third party, paid for by you. Be aware this is often done by someone who is not a specialist on the requirements in every state.

Alternatively, you can work with PACE Equity where the engineers are part of our team, managed by us, trained by us. We know the ins and outs of what should be included in the analysis — this factor alone can make or break your funding levels.

Another item to watch for is the subjectivity of a term sheet. If you are working with a PACE lender, a term sheet is only deliverable when the energy study is completed, meaning you will have a high degree of variability in your project that can lead to a surprise change in your funding.

Because of a robust initial analysis, PACE Equity commits to both a funding amount and terms upfront so you can plan and focus on delivering your project. Our 100% track record backs this up.

True Story

For a recent project, a third-party engineer performed an energy study and reached the conclusion of a maximum funding amount of over $400,000. Since the developer needed more than this, he contacted PACE Equity for another opinion. We analyzed the same property and concluded that $4 million was available for funding.

We are using the same local compliance requirements and same state legislation, so what was different?

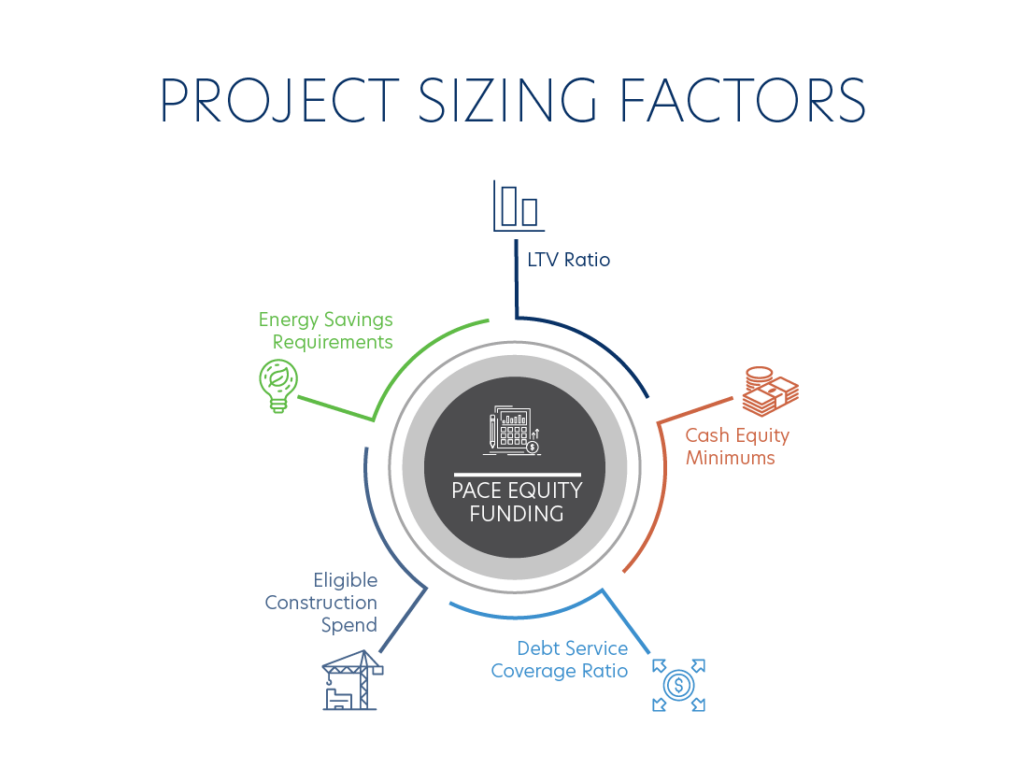

Critical Success Factors of Project Sizing:

- Deep knowledge of state and local codes and required energy ratios

- Proactive work with local program administrators

- Analysis of project financing data including:

- LTV ratio

- Project cash equity

- Debt service coverage ratio

- Eligible construction improvements

So how much can you get for your upcoming development project? Call PACE Equity and we’ll tell you.

In fact, we’ll commit to it.