This is an interesting time for commercial real estate development. Commercial needs are shifting, and we are all thinking about the future and what economic recovery will bring. The development fundamentals of available labor and market share are still strong – a good sign – developers still desire to build. The challenge is the pullback in construction lending. PACE Equity is seeing two general scenarios and has solutions for both.

Challenge 1:

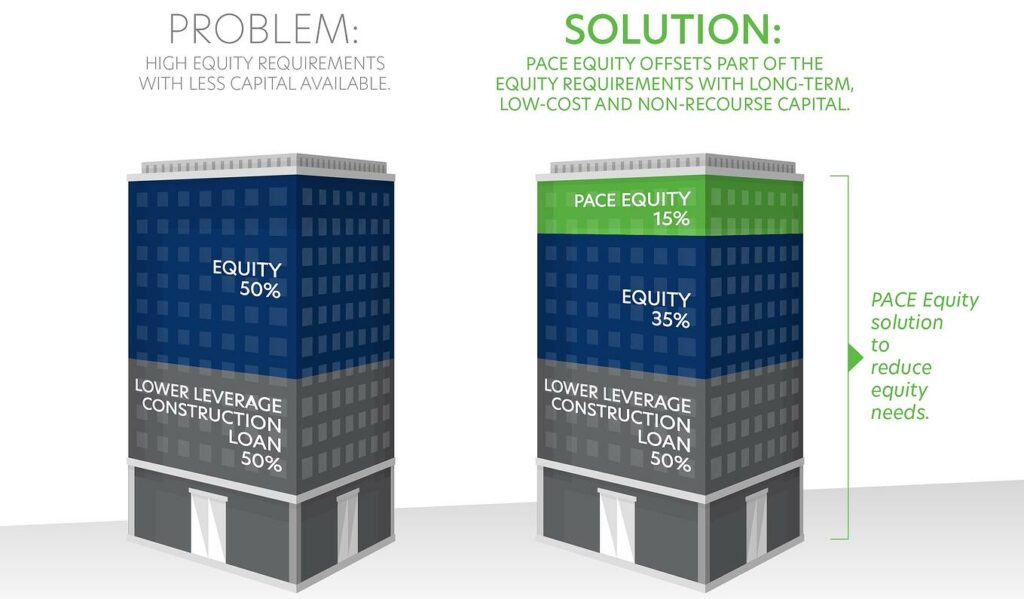

Banks are pulling back by reducing their loan-to-cost ratios. This makes project financing more difficult to assemble and developers are facing substantial additional equity requirements.

Solution:

If this is the case with your capital stack, PACE Equity can fill the void and fund a meaningful portion of the deleveraged amount, essentially making up the difference that banks no longer provide. We provide long-term, low-cost, non-recourse capital that cannot only fill the gap in your capital stack but can also reduce your WACC when you offset more expensive equity options.

Challenge 2:

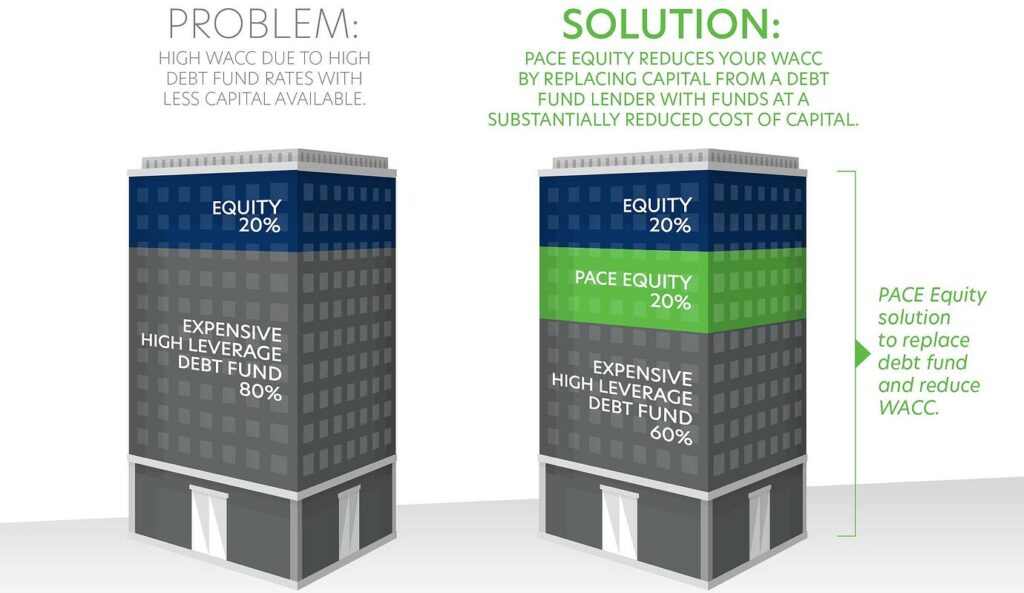

With banks offering less funding, debt funds offer an alternate source of capital. Debt funds can be attractive because capital is available, generally speaking, at higher leverage points than a bank. The challenge is that they typically lend at rates between 8-12%. In this case, developers are facing escalating costs of capital.

Solution:

In that case, PACE Equity is more attractive because it offers capital at significantly lower cost. You can get the higher leverage, but without the high cost of a debt fund. In short, substituting some of the debt funding with PACE Equity funding reduces your WACC and boosts project IRR. PACE Equity’s funding is generally 10-25% of the capital stack.

If you are facing higher equity requirements and/or escalating capital costs due to financing from debt funds, consider PACE Equity to solve these twin challenges. We offer financing that is long term, fixed rate and non-recourse.

As the leader and pioneer in PACE financing for development projects, we have also been very successful working with lenders to secure lender consent. We help banks understand that PACE financing doesn’t mean losing any rights or remedies to protect their security interests. We work directly with the primary lender to get them comfortable with the financing and process. We can even direct you to a lender we recommend with significant PACE Equity and commercial development experience.

Talk to a PACE Equity Managing Director today. Let us help you complete your capital stack – no matter how complex. And now more than ever, our low-cost financing can solve your financing challenges and reduce your WACC.