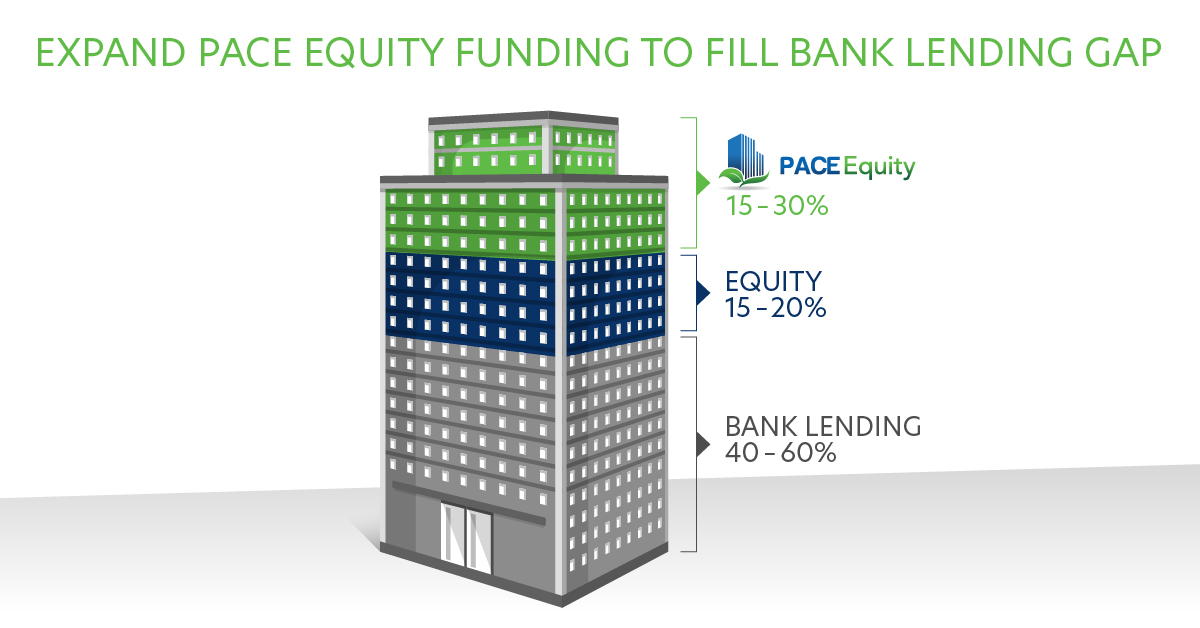

PACE Equity has always been a financial tool that can serve the role of “gap-filling” in the capital stack. With construction lending tightening, many developers are seeing construction loan leverage between 45-60% Loan to Cost (LTC). Many developers have been increasing the equity contributions to cover rising costs and rates; these LTCs simply do not make sense for many projects. Traditionally, PACE Equity has been a source of financing to replace mezz or preferred equity at a much lower cost, but in today’s banking environment, we are filling the bank lending gap.

PACE Equity provides low-cost funding for up to 30% of the capital stack. With a very narrow spread between SOFR (Secure Overnight Financing Rate) and the 10-year UST (US Treasury rate), our funding is similar to construction loan pricing.

If you find yourself with a funding gap from reduced bank leverage, consider using or expanding your PACE Equity funding. Our in-house engineers and building optimization professionals will identify the efficiency content in your construction budget so you can maximize the PACE Equity funds in your capital stack.

You can also consider using PACE Equity funds from our CIRRUS Low Carbon program which offers even lower cost of capital when you build a slightly greener building. CIRRUS Low Carbon offers a design specification, a low carbon engineer to join your design team, a significantly reduced cost of capital, and a marketing package to promote your greener building.

Contact your PACE Equity Managing Director today or Schedule a Meeting and we’ll connect you with someone who can provide the details.