Since PACE financing is still relatively new in many states, we often hear from clients that their mortgage lender is not familiar with PACE financing or has declined to participate. In fact, over 80% of our projects start with lenders who do not initially consent, but through our discussions we help them understand PACE and convert them to approvers! We believe education is the key to solving that challenge. If we can educate your lender about how the financing works and outline their protections, we can turn a ‘no’ into a ‘yes’.

How do we do that?

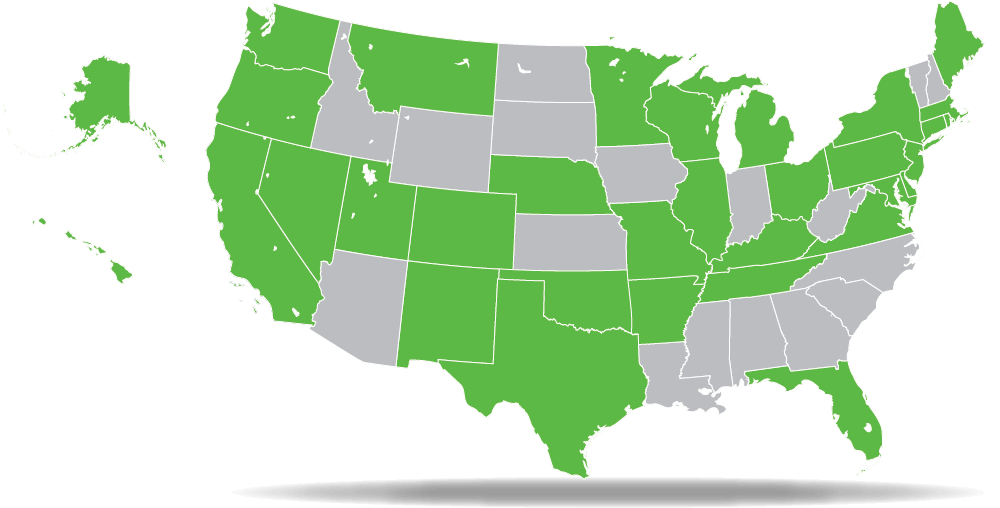

Over many years, we have developed tried and true key points to discuss with a lender. Over 300 lenders across the nation have worked on projects with PACE financing. Our Fast Track™ Funding process includes working with you on lender consent, even if it means many conversations and many lenders. We welcome a chance to speak to your lender or work with you to secure buy-in for your capital stack.

Lenders: What they Need to Know about PACE Equity

When PACE Equity is part of your financing, we help you educate your lender. We have relationships with lenders all over the country, or we will build a relationship with yours. Our team has closed over 300 projects, so we have significant experience with this!

- PACE Equity has a fixed payment (fixed term, fixed rate) and we have no ability to accelerate those payments. If payments are missed, we cannot “balloon” the payments. We can only collect what is due in arrears. This gives banks a sense of comfort that in the very unlikely event of a default, there is only a payment or two that would need to be caught up. We cannot put a lien on the building for the principal balance or future payments.

- We can be prepaid at any time (unlike a traditional tax assessment) and we can be transferred in the case of a sale. If a foreclosure occurs, for example, the bank can transfer the obligations to a future buyer without penalties or approvals needed from PACE Equity.

- We fully fund at closing, so the lender is secure in the knowledge that the funds are available for the project.

- Our payment can be part of a tax and insurance escrow, so the lender knows it is reserved and payments are being made. Some lenders require this, while others don’t.

- With PACE Equity, we are funding sustainability measures that are better than code. This means the building has enhanced property value and lower operating costs.

- We underwrite to combined standards between us and the lender (such as cash equity, LTV and combined DSCR) to ensure that there is a comfortable amount of funding and cushion for all parties. As a result, a property’s results can be “worse” than expected but the bank is still financially very well protected.

There are over 300 institutions across the U.S. that have participated, consented and approved PACE projects — banks that are large & small, regional & national. Lenders have analyzed the risks and provided consent — over and over and over.

PACE Equity has had many years of success with lender consent of our projects. In fact, our unique Fast Track™ Funding process includes these educational lender conversations in the end-to-end execution we offer.

Ask your local Managing Director more about lender consent. We can even suggest a lender if you’d like us to. Let’s get started on low-cost PACE Equity financing for your next project.

Lenders: What You Need to Know and FAQ (PDF)

Download our information sheet, FAQ, PLUS a list of over 300 Lenders who have already approved C-PACE participation.

-

Interview with James Reid from Investa Group on StorCo Storage and CIRRUS Low Carbon

“Proud to be the first storage facility with this designation.” StorCo Storage, a $3 million new construction self-storage project in, St. Louis, Missouri, is the first ever CIRRUS Low Carbon verified self-storage project. CIRRUS Low Carbon is the ONLY private financial product to offer a lower cost of capital for developments built with a lower…