Industry Thought Leadership

Ideas and content to help customers accomplish more

Find articles, videos and infographics on relevant industry topics.

- Video

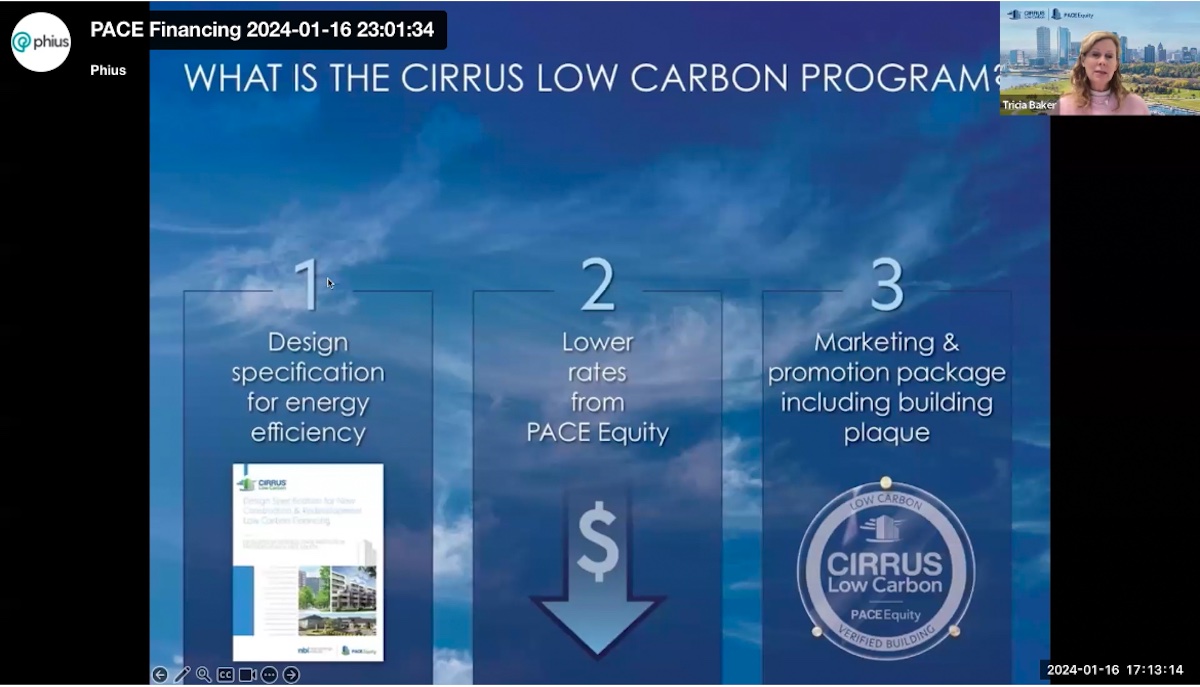

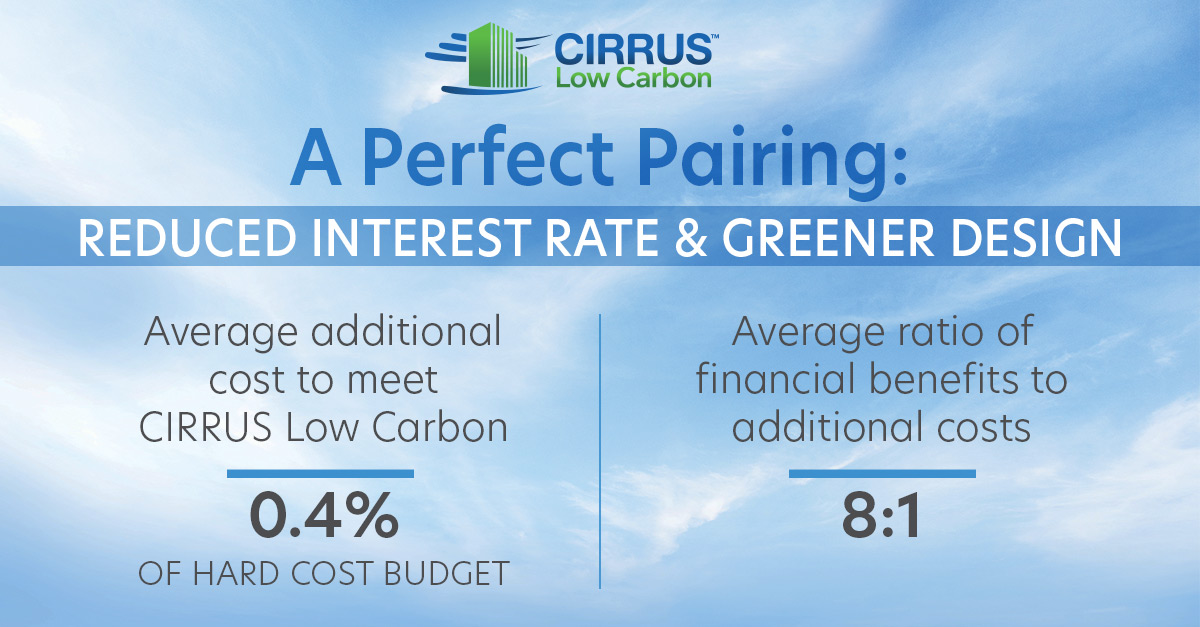

Interview with Tyler Parbs from J. Jeffers & Co. on Colman Yards and CIRRUS Low Carbon

- Article, Infographic

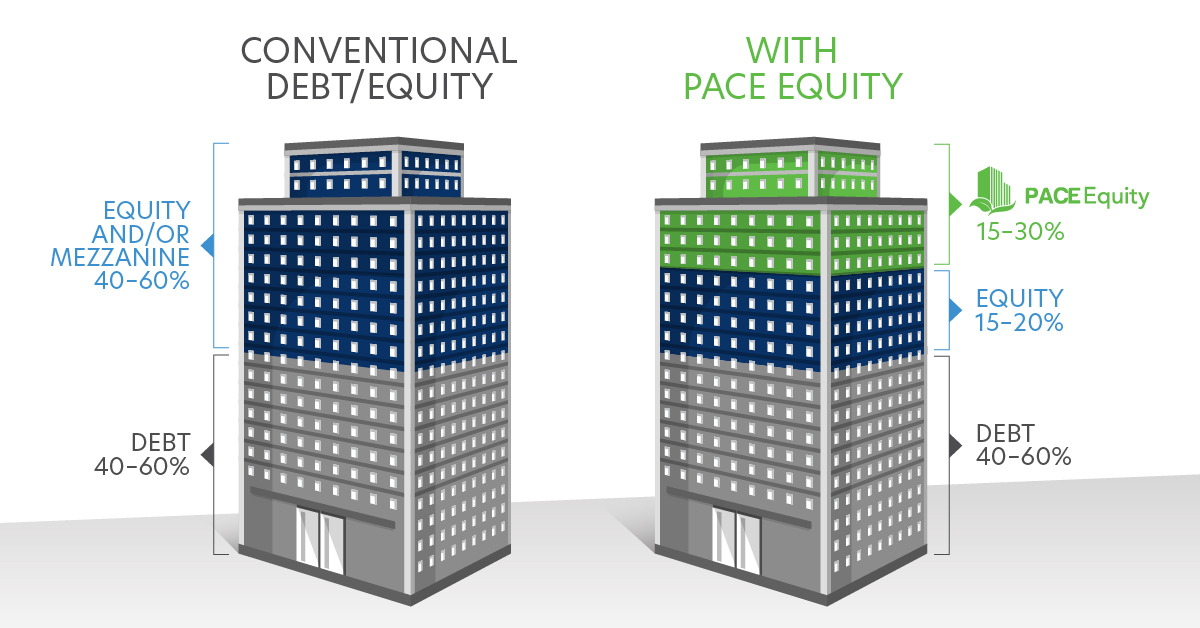

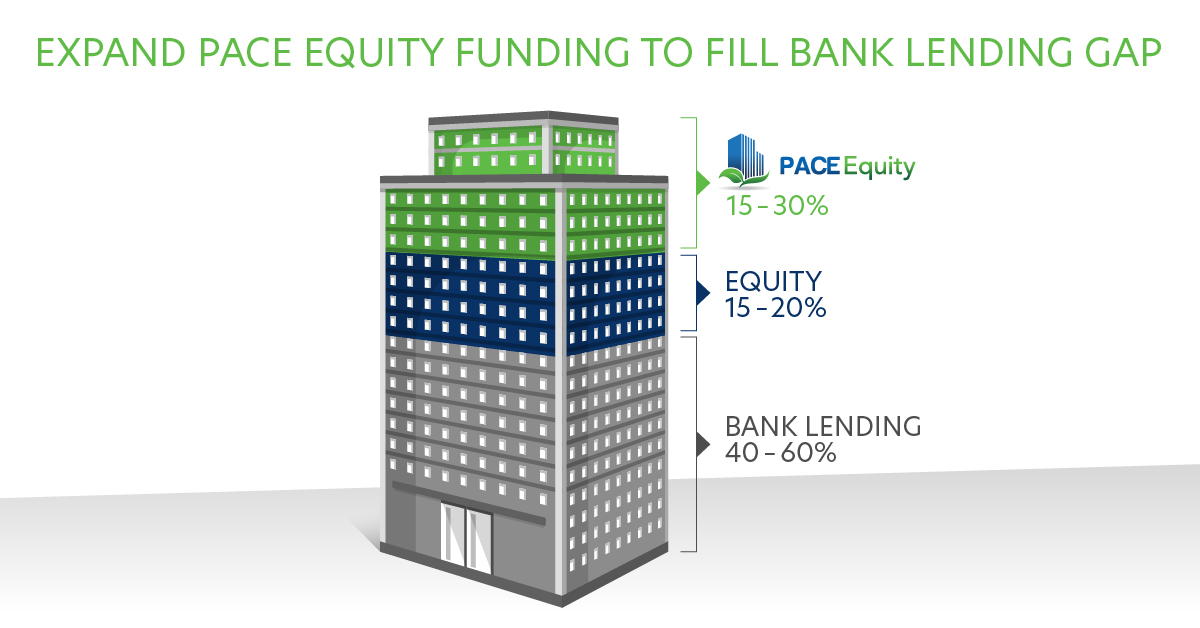

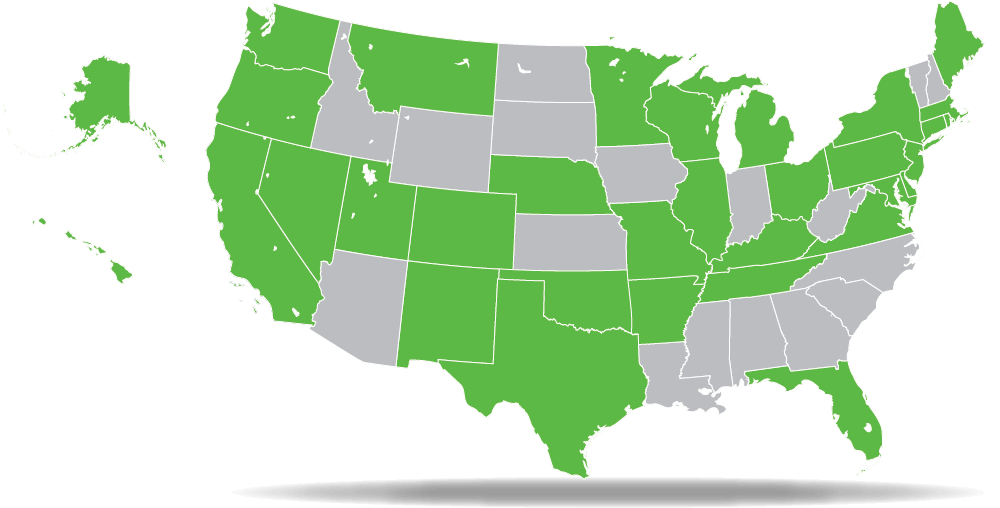

Construction Lending is Tightening. Let PACE Equity Fill 20-30% of your Capital Stack.

- Article, Infographic

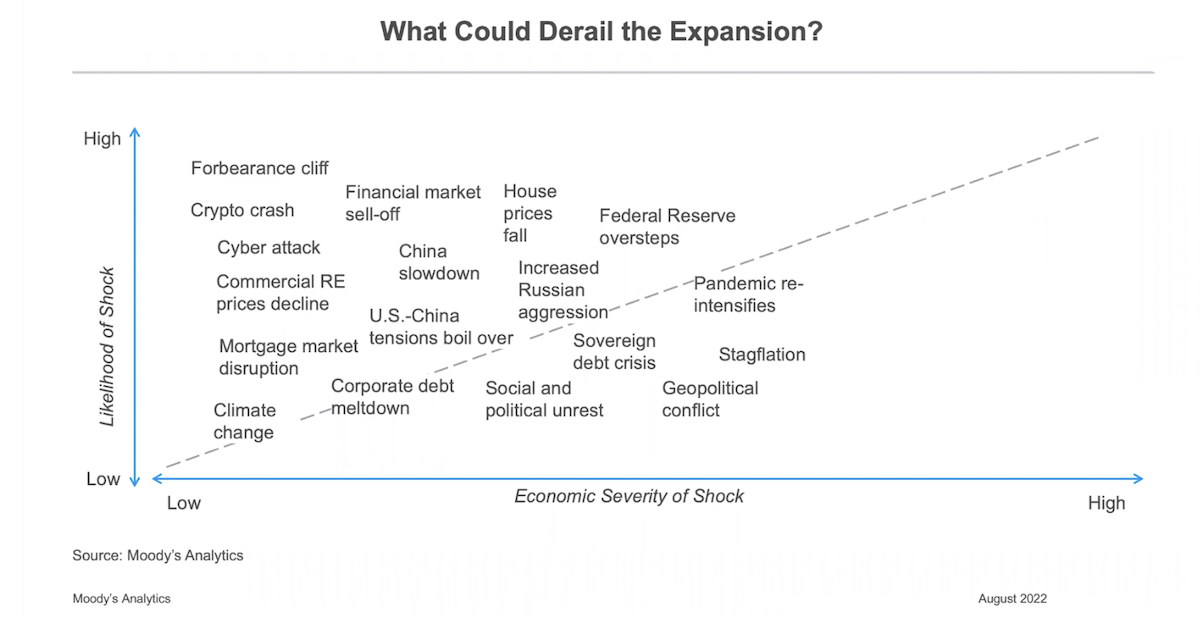

Moody’s Economist Says Positive Times Ahead for Multifamily; Other Commercial Real Estate Sectors May Have Some Adjusting to Do

Menu

Recent Closings

- Dallas, TX

- $15 Million

- Ashwaubenon, WI

- $1.1 Million

- Lake Worth Beach, FL

- $12.7 Million

- Tomball, TX

- $2.9 Million

- Port St. Lucie, FL

- $9.1 Million

© 2024 PACE Equity, Inc. All rights reserved | Privacy Policy

Website by LimeGlow Design